Tax depreciation myths debunked alert june 2019 deloitte depreciation in excel easy tutorial sum of years digits depreciation calculator depreciation in excel easy tutorial depreciation in excel.

Carpet depreciation calculator uk.

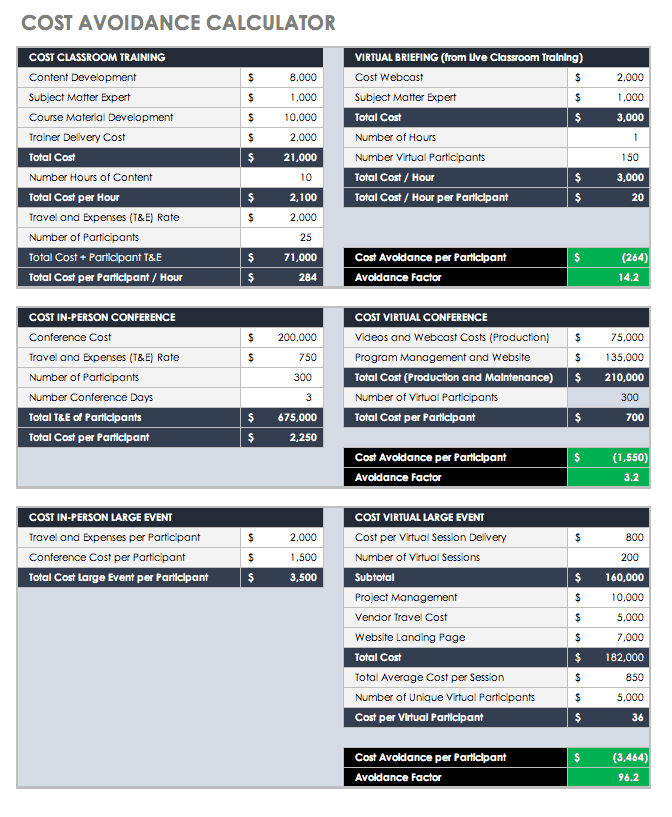

Download your copy today.

We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time.

The carpet calculator by carpet giant will help you estimate the cost of carpets laminate or vinyl flooring from our south west store.

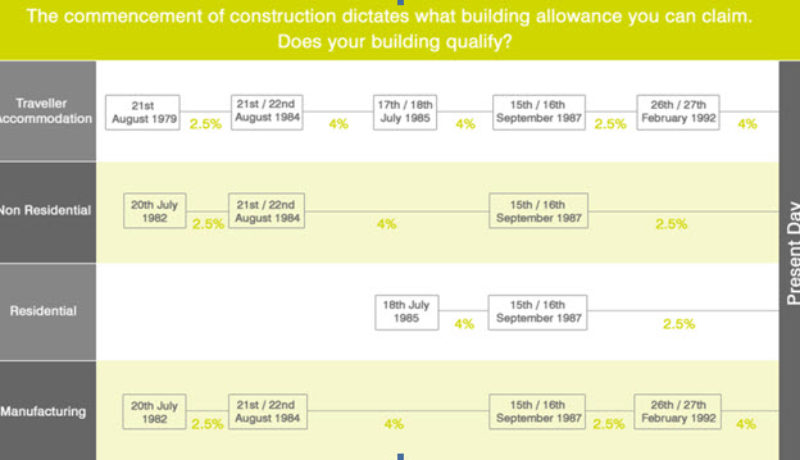

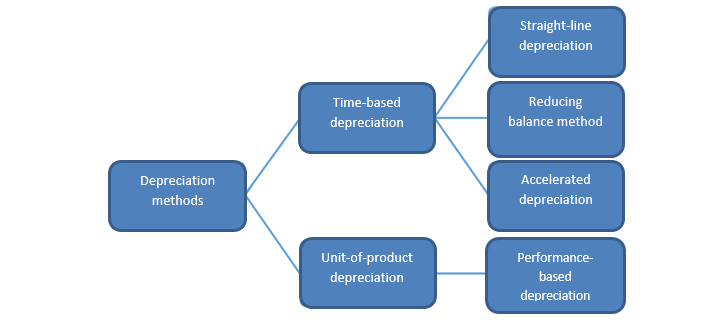

Uk depreciation and depreciation rates in business are accounting terms.

This free downloadable pdf is fantastic for calculating depreciation on the go or when you re without mobile service to access the online calculator.

There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

The depreciation guide document should be used as a general guide only.

Here you can work out the approximate cost of carpet.

Cut out the middleman and extra costs.

The depreciation guide document should be used as a general guide only.

As carpet width is usually 3 66m a price in lineal metres will be higher than in square metres please note that some of our carpets are 4 metres wide.

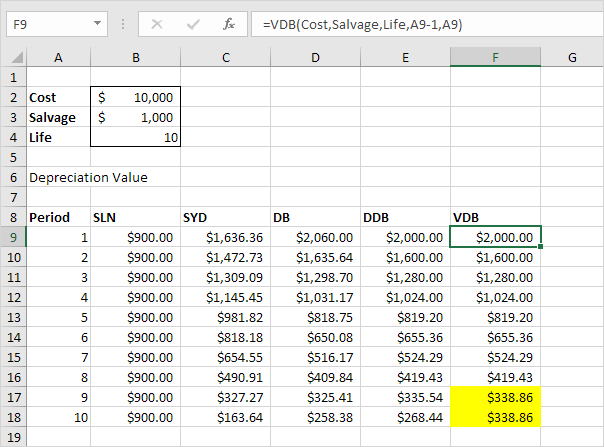

It will then calculate the next 5 years.

Take the final written down value from year 5 and enter it to the asset value.

Air purifiers deodorising and mould remediation assets including air filtering machines air scrubbers and ozone generators 5 years 40 00 20 00 1 jul 2010 carpet 5 years.

To use the calculator you will need to enter the value of the asset and then the percentage of depreciation for each year.

There are many variables which can affect an item s life expectancy that should be taken into consideration when determining actual cash value.

Visit the post for more.

Percentage declining balance depreciation calculator when an asset loses value by an annual percentage it is known as declining balance depreciation.

When a business buys fixed assets it will use it for a number of years.

Carpet upholstery and rug cleaning services assets.

For example if you have an asset that has a total worth of 10 000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9 000.